MS-10 December, 2015

MANAGEMENT PROGRAMME

Term-End Examination

December, 2015

MS-10 : ORGANISATIONAL DESIGN, DEVELOPMENT AND CHANGE

Time : 3 hours Maximum Marks : 100 (Weightage 70%)

Note : (i) There are two Sections A and B.

(ii) Attempt any three questions from Section-A. All questions carry 20 marks each.

(iii) Section-B is compulsory and carries 40 marks.

SECTION - A

1. What is Organizational Development (OD) ? Describe various stages of OD and their relevance.

2. Differentiating organization and institution, describe what characterizes an institution and factors influencing institution building.

3. Describe any two diagnostic tools and their advantages and disadvantages.

4. Distinguish between job, occupation, and career and discuss any two approaches of job design and their merits and demerits.

5. Write short notes on any three of the following :

(a) Hybrid Structure

(b) Time and Motion Study

(c) Process Consultation

(d) Process of Change

(e) Organisations as Political Systems

SECTION - B

6. Read the following case carefully and answer the questions given at the end :

Since 1994, Boeing began the process of remaking the company for the next round of aircraft purchases. Every part of the company is involved, from engineering to manufacturing. The focus of the change is that Boeing is a manufacturing company rather than an engineering and technology company. Due to changes in the air travel business, the major commercial airlines are demanding lower airplane prices and significantly lower operating costs. Airbus continues to be a fierce competitor, so Boeing must meet the competition early and on every front. (Boeing bought Mc Donnell Douglas in 1997.)

It is not as if the company is in financial trouble. Its new model 777 is generating lots of orders. Plans are in the works for a new supersonic and another jumbo jet for commercial sales, and several new project possibilities exist for the defence division. The new 777 was designed completely on the computer so that designs went straight from the designer'scomputers to the machine tools for manufacturing. It can carry as many as four hundred passengers, fifty more than the comparable Airbus 33 t. It is 15 per cent more fuel efficient, and can fly over eight thousand miles non-stop. Orders are coming in faster than

for any other new plane, although its price is pretty steep : $12 - $15 million, depending on

interior layout.

Boeing's new CEO, Philip Condit, must continue the reductions in cycle time and cost cutting, started by his predecessor, Frank Shrontz, because airlines are making their purchase decisions differently than in the past, even choosing in some cases to refurbish older planes rather than buy expensive new ones. The changes started with Condit and his team of presidents of the divisions of commercial planes, defence and space, and computer services. This group differs notably from its predecessors in that they have met together for several years to discuss the good and bad things about each other's divisions and

the future of the company. They all embrace the new togetherness theme as the primary means

through which the company will be able to reduce cycle times, improve delivery times, cut product

development time, and reduce total costs.

In the former structure the design and manufacturing groups were separate. Design and engineering groups would design the planes and then give the plans to manufacturing to build. When problems existed in the design, they would be sent through the hierarchy back to engineering for correction. Under the new structure, comprehensive design-and-build teams include members of all groups involved. Therefore, planes are originally designed to meet customer's needs, are easier to build, and corrections are made faster. For example, previously, when tool builder Tony Russell had a problem with an engineering design or specification, he would have to go to his supervisor and the problem would be shuffled through to engineering. Now he goes directly to the engineering and design group, gets the problem solved, and gets back to work with the correct design. This type of revision in the process

has helped reduce the product delivery time from eighteen to ten months. The team approach and working-together ideas were used extensively on the 777. Some teams included tool makers, designers, manufacturing workers, suppliers, and even customer representatives. Contrary to past procedures, workers on the line were allowed to change how planes were built, which has significantly decreased costs. Condit has instituted 360 degree performance reviews in which managers are evaluated by their subordinates, their peers, and their own supervisors to improve understanding of how they are doing from all perspectives. Employee empowerment is increasing at all levels. Condit and his team are having quite an impact throughout the company.

Questions :

(a) The new way of organizing at Boeing most resembles which of the classical types of organizing ? Justify.

(b) How have responsibility and authority been altered under Condit's new approach ?

(c) Describe the new ways of organizing at Boeing in terms of the configurational and operational aspects of structure

MS-4 December, 2015

MANAGEMENT PROGRAMME

Term-End Examination December, 2015

MS-4 : ACCOUNTING AND FINANCE FOR MANAGERS

Time : 3 hours Maximum Marks : 100

Note : (i) Attempt any five questions.

(ii) All questions carry equal marks.

(iii) Use of calculators is allowed.

1. (a) Explain the 'Accrual Concept' and the 'Consistency Concept' in accounting and signify their importance to an accountant.

(b) Distinguish between 'Operating Profit' and 'Net Profit'. Which is a measure of operational efficiency of a company ? Distinguish between Capital expenditure and Revenue expenditure. Which is taken

into account for determining the Operating Profit ?

2. What do you understand by Fund Flow Statement ? How does it differ from a Cash Flow Statement ? Explain the main items which are shown in the fund flow statement and the purpose of preparing this statement.

3. What do you understand by Discounted Cash Flow Techniques of Capital Budgeting ? Briefly

explain the Net Present Value Method and Internal Rate of Return Method of appraisal of

projects. Which of the two would you rank better and why ?

4. Distinguish between :

(a) Profitability Index and Profitability Ratios.

(b) Earnings Yield and Dividend Yield.

(c) Fixed Budget and Flexible Budget.

(d) Direct Labour Rate Variance and Direct Labour Efficiency Variance.

5. Explain the following statements, giving reasons :

(a) Debt is a double-edged weapon.

(b) Depreciation acts as a Tax Shield.

(c) Fixed Costs are variable per unit and Variable Costs are fixed per unit.

(d) When the use of operating and financial leverages is considerable, small changes insales will produce wide fluctuations in Return on Equity and E.P.S.

6. "Zero-based Budgeting provides a solution for overcoming the limitations of a traditional

budget". Explain this statement and describe the process of preparing a Zero-based Budget.

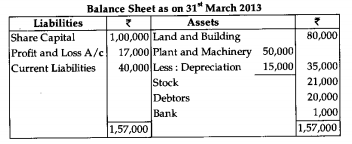

7. Following is the abridged Balance Sheet of ABC Company Ltd. as on 31st March 2013.

With the help of additional information given below, you are required to prepare Profit and Loss

Account and a Balance Sheet as on 31st March 2014.

(a) The Company went in for re-organisation of capital structure with the share capital

remaining the same but other liabilities were as follows :

Share Capital 50%

Reserves 15%

5% Debentures 10%

Trade Creditors 25%

Debentures were issued on 1st April, interest being paid annually on 31st March.

(b) Land and Buildings remain unchanged. Additional Plant and Machinery has been purchased and a further depreciation (f 5000) written off.

(The total fixed assets then constructed 60%of the total gross fixed and current assets.)

(c) Working Capital Ratio was 8 : 5.

(d) Quick Assets Ratio was 1 : 1

(e) Debtors (4/5th of quick assets) to sales ratio revealed a credit period of 2 months. There

were no cash sales.

(f) Return on Net Worth was 10%.

(g) Gross Profit was @ 15% of sales.

(h) Stock Turnover was eight times for the year ignore taxation.

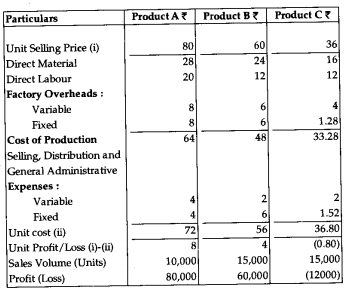

8. While finalising the plans for the Coming Year the excutives of XYZ Co. Ltd. thought that it will be advisable to have a look at the product-wise performance during the current year. The

following information is furnished :